Program Overview

$25 Apple Watch

Life Insurance that rewards you for healthy living.

Simple and affordable plans with no medical exams and cash-back options.

Life Insurance that rewards you for healthy living.

Simple and affordable plans with no medical exams and cash-back options.

What is Life Insurance

Life insurance is a contract with an insurance company. You are protected through the lifetime of the contract in exchange for monthly or annual payments. If you were to die while your policy was active, your chosen beneficiary (more on beneficiaries later) would receive a sum of cash. Your beneficiary might use this money, called a death benefit, to pay final expenses, pay the rest of your mortgage, or cover any expenses for your loved ones. In most cases, the death benefit is tax-free

What is Life Insurance

Life insurance is a contract with an insurance company. You are protected through the lifetime of the contract in exchange for monthly or annual payments. If you were to die while your policy was active, your chosen beneficiary (more on beneficiaries later) would receive a sum of cash. Your beneficiary might use this money, called a death benefit, to pay final expenses, pay the rest of your mortgage, or cover any expenses for your loved ones. In most cases, the death benefit is tax-free

Why do I need Life Insurance?

Life insurance is for your loved ones. Would they be financially prepared to cover the household expenses if you were no longer around to help with the family bills? If you are carrying debt or have a mortgage, would your family be able to cover these expenses in case of your death? Life insurance provides cash benefits to cover these costs, so your family will not face a financial hardship during an already challenging time. We think that life insurance translates into an act of love for those you care about.

Why do I need Life Insurance?

Life insurance is for your loved ones. Would they be financially prepared to cover the household expenses if you were no longer around to help with the family bills? If you are carrying debt or have a mortgage, would your family be able to cover these expenses in case of your death? Life insurance provides cash benefits to cover these costs, so your family will not face a financial hardship during an already challenging time. We know that life insurance translates into an act of love for those you care about.

Who needs life insurance?

If you were to die, would you leave behind debt, or would your loved ones face a financial hardship? If the answer is yes, you need life insurance.

If you are married, have dependents, own a small business, or you would leave behind a sizable personal estate, you need life insurance. If you are single, you do not have any dependents, or you would not leave behind debts related to business, personal or medical expenses, you probably don’t need life insurance right now.

Who needs life insurance?

If you were to die, would you leave behind debt, or would your loved ones face a financial hardship? If the answer is yes, you need life insurance.

If you are married, have dependents, own a small business, or you would leave behind a sizable personal estate, you need life insurance. If you are single, you do not have any dependents, or you would not leave behind debts related to business, personal or medical expenses, you probably don’t need life insurance right now.

We are here to help you find the best-fit plan for your life. Get a free quote speak with one of our professionals and apply in 10 minutes for a personalized term life insurance policy.

When should I buy life insurance?

Buying life insurance while you are young and healthy can help you secure lower premiums. Your best bet is to get life insurance as soon as it becomes a must-have in your life. Life events such as marriage, a new baby, and even starting a business can trigger a need for life insurance. If you are planning to have a baby soon, it is best to secure coverage before your pregnancy to ensure you do not face higher premium rates.

We are here to help you find the best-fit plan for your life. Get a free quote and apply online in 10 minutes for a personalized term life insurance policy.

When should I buy life insurance?

Buying life insurance while you are young and healthy can help you secure lower premiums. Your best bet is to get life insurance as soon as it becomes a must-have in your life. Life events such as marriage, a new baby, and even starting a business can trigger a need for life insurance. If you are planning to have a baby soon, it is best to secure coverage before your pregnancy to ensure you do not face higher premium rates.

How much life insurance do I need?

When you are shopping for life insurance, you will see a lot of information out there about term lengths and coverage amounts. There is not a one-size-fits-all answer for life insurance: the perfect fit depends on your unique circumstances. You will want to look at your income, your health, your family, and your goals to determine how much insurance you need. And keep in mind that your policy can grow with you, so there is no wrong answer.

To determine much life

insurance you need, ask yourself:

How much life insurance do I need?

When you are shopping for life insurance, you will see a lot of information out there about term lengths and coverage amounts. There is not a one-size-fits-all answer for life insurance: the perfect fit depends on your unique circumstances. You will want to look at your income, your health, your family, and your goals to determine how much insurance you need. And keep in mind that your policy can grow with you, so there is no wrong answer.

To determine much life

insurance you need, ask yourself:

How much do you contribute to your household income?

If you have children, do you want to save money for their college education?

Would your loved ones be financially prepared to cover your funeral expenses?

How much debt would you leave behind?

How will inflation affect these numbers?

How much do you contribute to your household income?

If you have children, do you want to save money for their college education?

Would your loved ones be financially prepared to cover your funeral expenses?

How much debt would you leave behind?

How will inflation affect these numbers?

Types of life insurance?

Types of life insurance?

When it comes to buying life insurance, you have a lot of options.

Every type of life insurance has its own unique advantages, and many options even pair nicely together. With most options, you can add riders to your policy, meaning that you could protect against a critical illness or disability on top of your 15-year term life policy. We will cover more on riders later – below are the types of life insurance on the market today

When it comes to buying life insurance, you have a lot of options.

Every type of life insurance has its own unique advantages, and many options even pair nicely together. With most options, you can add riders to your policy, meaning that you could protect against a critical illness or disability on top of your 15-year term life policy. We will cover more on riders later – below are the types of life insurance on the market today

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10-30 years. If you die while the policy is in force (during the time you’re paying premiums), your beneficiary receives a death benefit.

If you reach the end of your coverage period, you and the insurance company simply part ways. If you still need life insurance, you can extend coverage for a new term or convert your policy to permanent life insurance (just keep in mind your premiums might increase).

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10-30 years. If you die while the policy is in force (during the time you’re paying premiums), your beneficiary receives a death benefit.

If you reach the end of your coverage period, you and the insurance company simply part ways. If you still need life insurance, you can extend coverage for a new term or convert your policy to permanent life insurance (just keep in mind your premiums might increase).

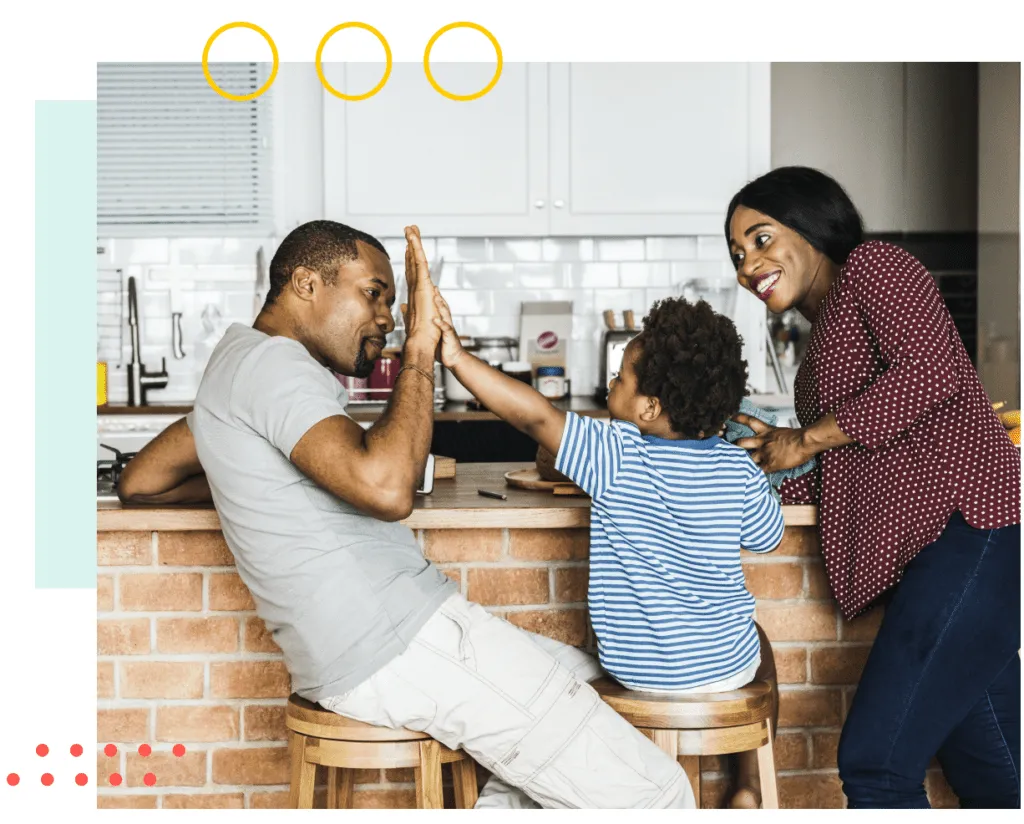

Permanent Insurance

Permanent life insurance offers guaranteed coverage and is sometimes broken down into a policy called universal or whole life.

Universal life insurance is an affordable permanent life insurance option with coverage that lasts a lifetime. Universal life insurance is popular for its affordability compared to other permanent life insurance options as well as for its adjustable benefits and cash value component.

Whole life insurance is a slightly more expensive type of a permanent life insurance policy that provides fixed premiums throughout the life of the policy, and coverage lasts until you die.

All permanent life insurance policies provide coverage for a lifetime. These policies also offer flexibility on premium payments and adjustments to policy terms. Many people opt for universal life because it has a cash value component that accumulates throughout the entire life of the policy. If you miss a payment, the cash value can step in and keep your policy active

Permanent Insurance

Permanent life insurance offers guaranteed coverage and is sometimes broken down into a policy called universal or whole life.

Universal life insurance is an affordable permanent life insurance option with coverage that lasts a lifetime. Universal life insurance is popular for its affordability compared to other permanent life insurance options as well as for its adjustable benefits and cash value component.

Whole life insurance is a slightly more expensive type of a permanent life insurance policy that provides fixed premiums throughout the life of the policy, and coverage lasts until you die.

All permanent life insurance policies provide coverage for a lifetime. These policies also offer flexibility on premium payments and adjustments to policy terms. Many people opt for universal life because it has a cash value component that accumulates throughout the entire life of the policy. If you miss a payment, the cash value can step in and keep your policy active

Mortgage Protection Insurance

Mortgage protection is a type of term life insurance designed to cover your mortgage payments if you pass away while the policy is in force. For many people, their home is their most valuable asset, so this insurance ensures that their loved ones could stay in the home rather than face a financial hardship if the primary breadwinner was no longer around to help pay the bills. Many mortgage protection policies also offer coverage if the homeowner becomes disabled or receives a critical illness diagnosis.

Mortgage Protection Insurance

Mortgage protection is a type of term life insurance designed to cover your mortgage payments if you pass away while the policy is in force. For many people, their home is their most valuable asset, so this insurance ensures that their loved ones could stay in the home rather than face a financial hardship if the primary breadwinner was no longer around to help pay the bills. Many mortgage protection policies also offer coverage if the homeowner becomes disabled or receives a critical illness diagnosis.

Final Expense Insurance

Final expense insurance is a type of permanent life insurance policy that provides a lump sum to your chosen beneficiary to cover end-of-life expenses. If you buy final expense insurance and continue to pay premiums during the life of the policy, your beneficiary will receive the death benefit when you die. They can use the death benefit to cover costs related to your passing, including medical expenses, a memorial, or funeral service. Many families don’t have the funds readily available to cover funeral expenses, which generally cost around $10,000. Final expense insurance steps in to pay for the burial and any other expenses your family needs, so they don’t have to face a financial burden during a difficult time.

Final Expense Insurance

Final expense insurance is a type of permanent life insurance policy that provides a lump sum to your chosen beneficiary to cover end-of-life expenses. If you buy final expense insurance and continue to pay premiums during the life of the policy, your beneficiary will receive the death benefit when you die. They can use the death benefit to cover costs related to your passing, including medical expenses, a memorial, or funeral service. Many families don’t have the funds readily available to cover funeral expenses, which generally cost around $10,000. Final expense insurance steps in to pay for the burial and any other expenses your family needs, so they don’t have to face a financial burden during a difficult time.

The perfect time to get life insurance doesn’t exist.

- No Medical Exam

- Affordable Term Life

- Rates Never Increase

- Coverage Never Decreases

- Protect Your Family

- Peace Of Mind

There’s no one-size-fits-all insurance plan.

We shop more than 80 major insurance companies to

help you find the best policy at the best price.

Active Rewards Partners

Ready to start?

Get a free quote in seconds based on your insurance needs, then continue to our online application and secure the coverage you need in 10 minutes. It’s that simple.

Connect With Us

Contact Us

Monday - Friday

9am - 9pm ET

Connect With Us

Contact Us

Monday - Friday